This is a basis of Taxation need to be known for those who wanted to invest in the property field. The definition of Real Property Gain Tax (RPGT) is

"The chargeable gains arising from the disposal of any land situated in Malaysia or any interest, option or other right in or over such land or the disposal of shares in a 'real property company' is subject to Real Property Gains Tax. "

In the trading of property, Capital gains are generally not subject to tax in Malaysia. Unless, when disposal of dischargeable asset take place, then, the RPGT is only charged on GAINS arising from this disposal of real property.

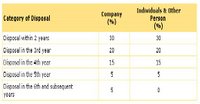

The rates of tax are as follows:

Usually, there are a lot of deduction and exemption in this taxation. One of them is - Tax Free for 1 disposal of property gain in once lifetime of individual.

Usually, there are a lot of deduction and exemption in this taxation. One of them is - Tax Free for 1 disposal of property gain in once lifetime of individual.

"A once in a lifetime exemption on a gain accruing to an individual who is a citizen or a permanent resident or to a husband and wife in respect of the disposal of one private residence."

quoted, http://www.hasilnet.org.my/english/eng_NO2_1_3.asp

Rule of thumb here, you only sell off your property on the 6th year. Then, there will be no tax on you. Unless, you are a frequent property "trader" who closing many deals in short term. Don't confuse RPGT VS Income Tax, there are completely different taxation.

0 comments:

Post a Comment